In the second quarter of 2023, the average household debt was roughly $101,000 according to experian. This number has slowly increased throughout the years and will continue to do so without change.

One of the major causes of this debt is by not being financially intelligent. To help with this problem, Pennsylvania lawmakers have passed a bill requiring schools to teach financial literacy.

The law will be effective by 2026 and will require all schools in PA to implement a financial literacy program into the curriculum. This course will not be a requirement for graduation but will still be a requirement to take.

These classes will help in providing a strong foundation on the basic principles of earning, spending, saving, and investing money as well as credit cards and interest rates. Teaching students at least a little bit of financial literacy will help in fighting the world debt problem.

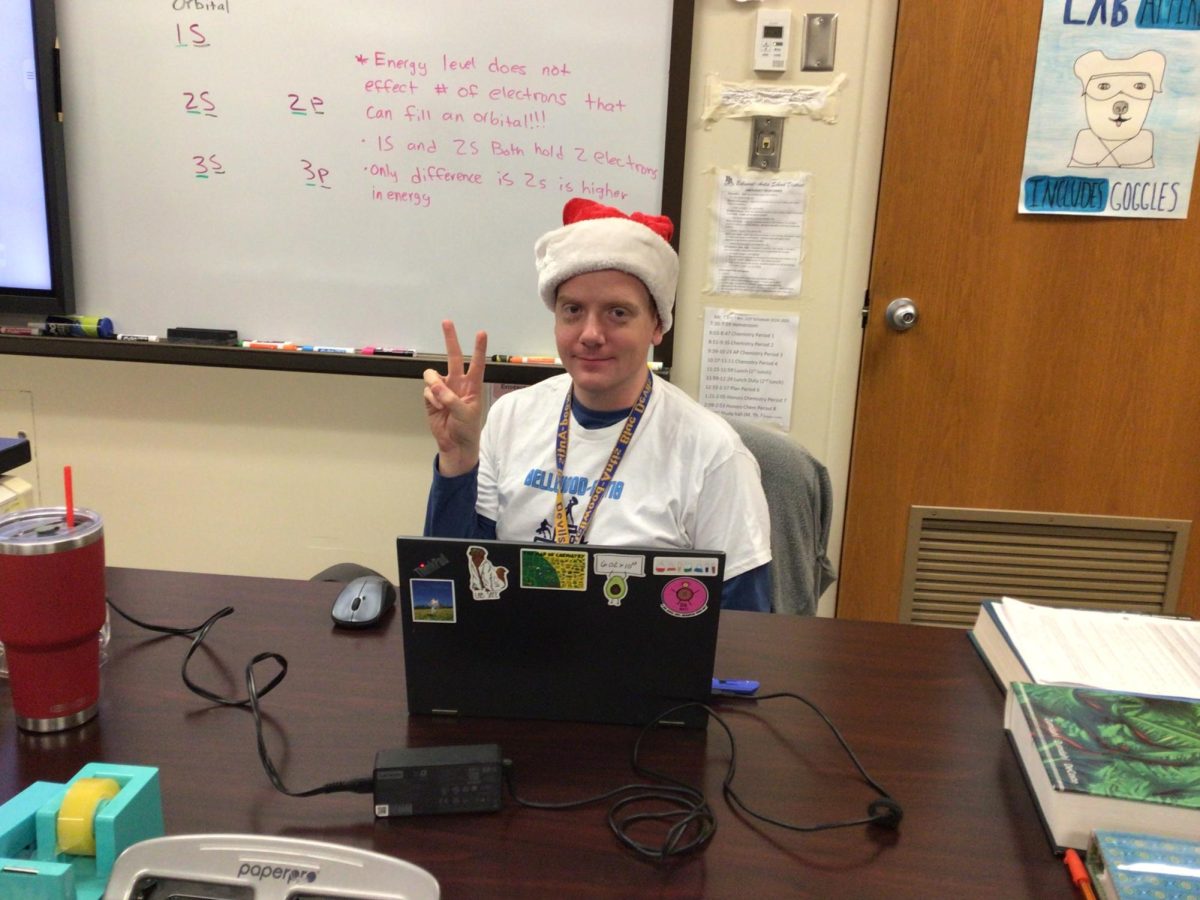

The new law won’t greatly impact B-A, which already offers a course in financial literacy.

Mr. Hallahan, Bellwood-Antis’s financial literacy teacher, is glad to finally see a bill like this one.

“You are seeing more and more states pass bills like this one. Financial literacy is such a key component of growing up, and life outside of high school,” he said.

The minimum high school standard will include:

- The true cost of credit.

- Choosing and managing a credit card.

- Borrowing money for an automobile or other large purchase.

- Home mortgages.

- Credit scoring and credit reports.

- Planning and paying for postsecondary education.

The content of the curriculum will follow the standards of Voluntary National Content Standards in Economics and the 2013 National Standards for Financial Literacy, as developed by the Council for Economic Education.

Currently, Bellwood-Antis offers a financial literacy curriculum for students in 11th grade. However, this class is only one semester providing a shorter time frame to educate students. This new bill may change this class into an all year class.