Far from failing financial literacy

Pennsylvania receives an F, but Bellwood-Antis deserves an A

Pennsylvania scored poorly on one recent test of financial literacy, but Bellwood-Antis goes above and beyond.

January 15, 2016

In America, there is no requirement to teach high school students financial literacy. However, Champlain College’s Center for Financial Literacy gives each state a grade, A-F, to represent its efforts to ensure their students learn financial literacy.

On the most recent evaluation, Pennsylvania received an F, along with 11 other states. An F means that a high school student could conceivably graduate from high school without ever having the opportunity to take a course with financial literacy topics.

However Bellwood-Antis is once again going above and beyond the normal standards of education. B-A has not just one, but two opportunities for students to take a course on financial literacy.

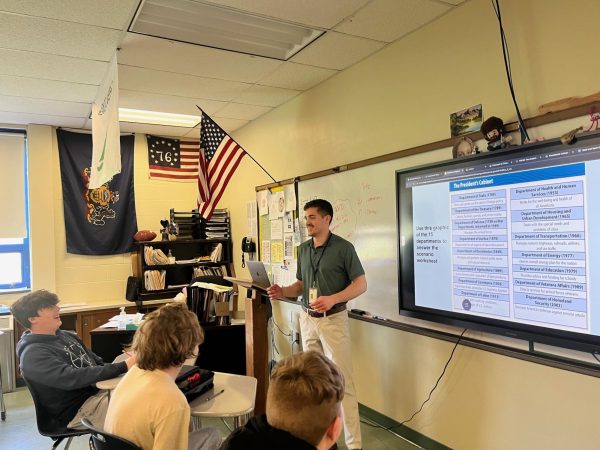

Bellwood actually has a class called Financial Literacy. Mr. Gabrielson, teacher of all high school computer classes and the Financial Literacy teacher, feels very strongly about preparing students for life in the real world.

Everything we learned in Financial Literacy was really beneficial. I will definitely remember this class when I graduate.

— Makala Doyle

“Without exposure to financial literacy in high school, students end up making these (getting a job, retirement, buying a house, etc.) real-life decisions without adequate preparation, or end up being surprised by financial situations when it is too late to do anything about them,” said Mr. Gabrielson. “All topics we discuss in the semester-long Financial Literacy course will, at some time in the future, be relevant to students.”

According to the rating scale, for a state to get an A, half-year personal finance courses must be required in order to graduate.

“Everything we learned in Financial Literacy was really beneficial. I will definitely remember this class when I graduate, and it will be one of the few classes that I can take something away from,” said senior Makala Doyle.

Even though financial literacy and senior seminar are not required in order to graduate, they are still available for B-A students to take, and are extremely important.

Senior Seminar is a class that meets every Friday to discuss real-world topics, including those of finance. Mr. Jim Mackereth, who instructs the seminar, said his class covers topics like checking accounts, credit cards and loans, and applying for jobs and scholarships.

“I think it’s a valuable class. We learn things like changing the oil in a car, balancing checkbooks, and how to budget,” said senior Caroline Showalter.

Just like Bellwood, schools in other states fall into this same category. Just because a state received an F doesn’t mean it’s failing to attempt to teach financial literacy. For example, Wisconsin and Massachusetts also received an F, but there are councils and models of financial literacy programs in these states as well.

The most famous quote from any high school graduate is, “I wish I had learned something important in high school that would help me in life.”

Despite common comments like this, Bellwood-Antis is raising the bar for Pennsylvania, and striving to teach its students financial literacy.